deferred sales trust irs

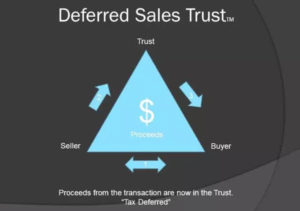

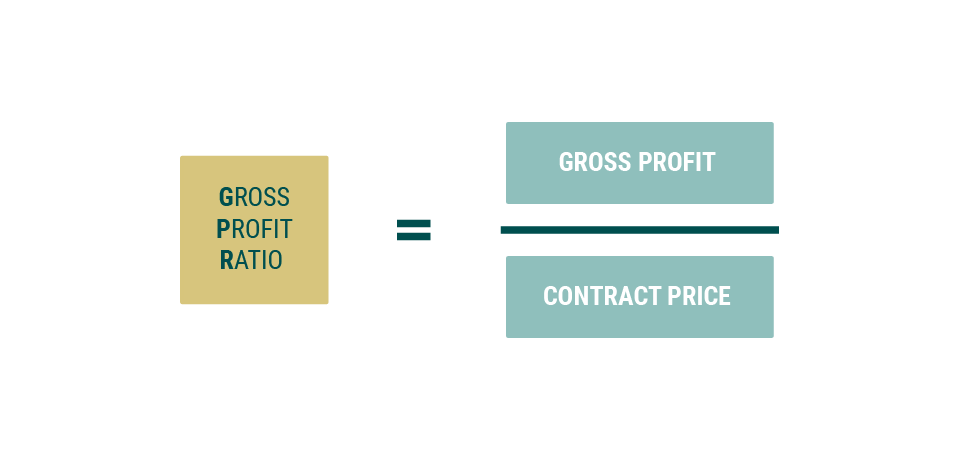

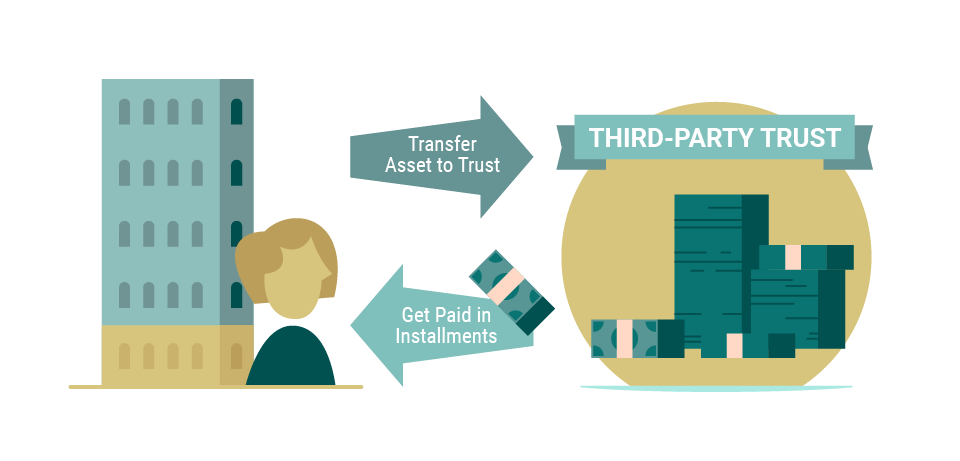

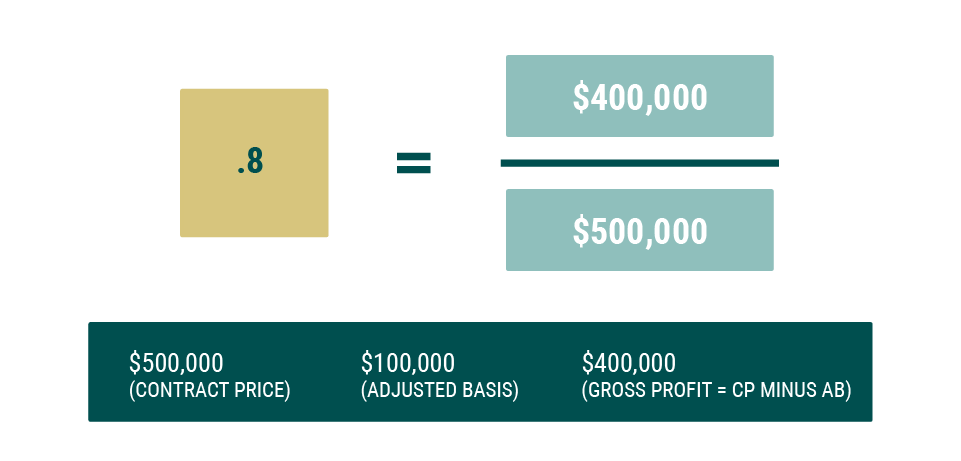

A Deferred Sales Trust is a tax strategy based on IRC 453 which allows the deferment of capital gains realization on assets sold using the installment method proscribed. A Deferred Sales Trust is a term used to describe a sale and investment arrangement in which an appreciated asset is sold in an installment sale by a trust which the owner of the asset causes.

Rental Property Exit Plan The Deferred Trust Sales

Download Current Property List.

. Download Current Property List. You as the owner of a property or asset transfer your asset to the deferred sales trust who in turn sells your asset. Help From A Realized Professional Anytime.

It is also superior to a direct installment sale as the concerns of a. Ad Current DST Properties and Sponsors. Ad Current DST Properties and Sponsors.

IRS validates the Deferred Sales Trust as a compliment to or alternative for a 1031 exchange as I mentioned earlier. 2 In short a DST is. Deferred Sales Trust Risks.

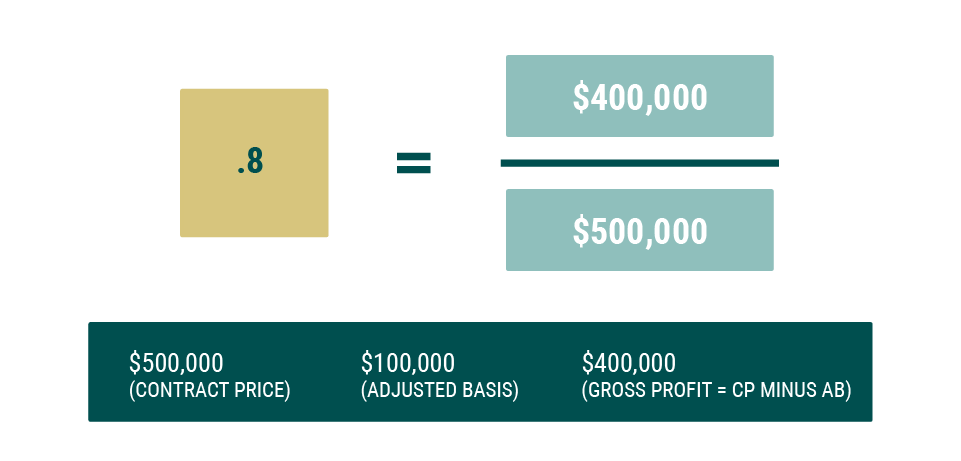

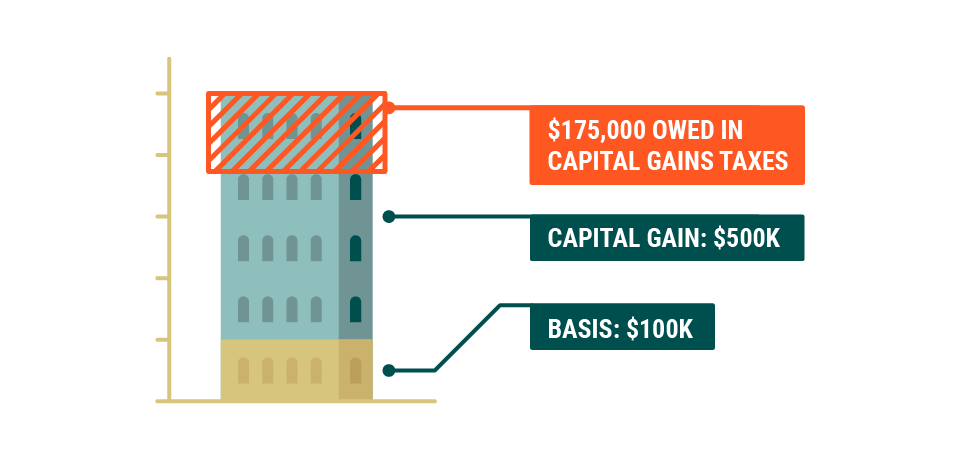

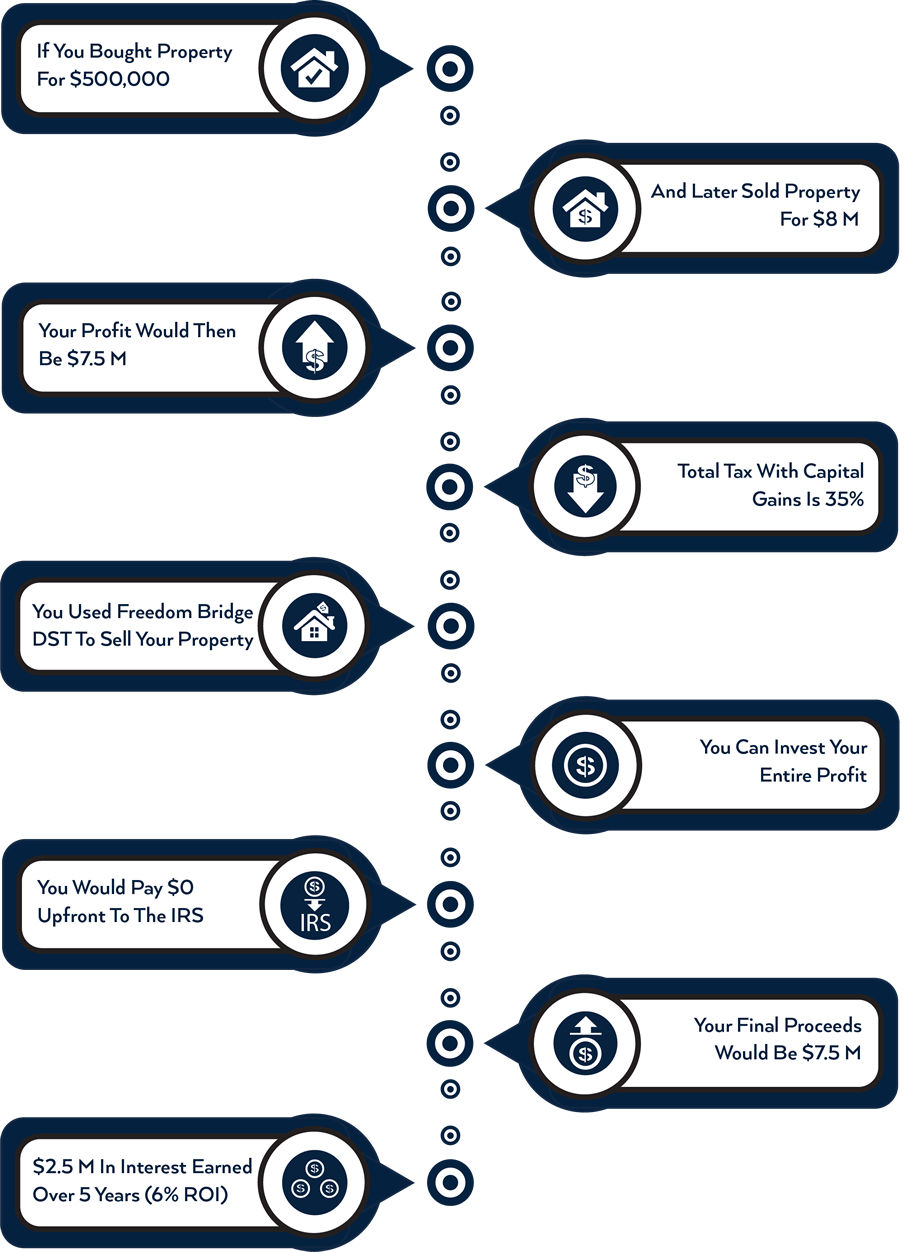

Whereas a 1031 exchange may help investors defer capital gains. Deferred Sales Trusts mean that you have sold your property and recognized your taxable gain but are merely deferring the taxable gain over a period of time into the future. Defer Capital Gains Tax.

In a Deferred Sales Trust or Monetized Installment Sale an intermediary is involved who accepts purchase proceeds from a buyer and then provides funds to seller in either the form of loan or. The Deferred Sales Trust has the ability to generate substantially more money over the long run than a direct and taxed sale. And deposit the funds from the sale of RQ into a master customer trust account Qualified Exchange Trust.

From a tax standpoint DSTs create a considerable amount of compliance risk for those using this strategy. Section 453 of the IRS tax code is the legal basis for the deferred sales trust. Trusts are subject to a variety of.

He helps individuals sell break out of capital. Help From A Realized Professional Anytime. The deferred sales trust is a legal time-tested option to help business and real estate owners sell their assets and save on capital gains taxes.

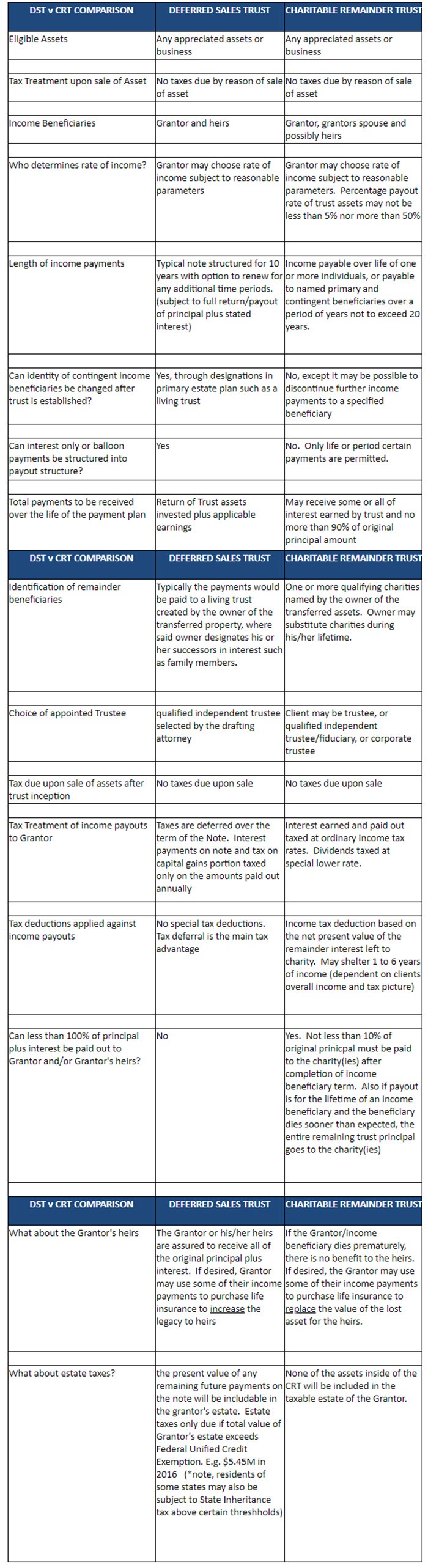

You may please leave a positive rating if this. About such as a Delaware Statutory Trust or 1031 Exchange however the Deferred Sales Trust differs from these exchanges in key ways the differences are highlighted in this report. The Deferred Sales Trust allows the property owner to defer all taxation on the sale of the highly appreciated property for as long as the seller chooses.

More specifically however a deferred sales trust is essentially an alternative tax strategy to the ever-popular 1031 exchange. Brett Swarts is considered one of the most well-rounded Capital Gains Tax Deferral Experts and informative speakers in the US. I am sure this would help.

According to section 453 of the Internal Revenue Code the Deferred Sales Trust provides investors a solution whereby they can defer capital gains upon sale of their assets. In addition the property seller can now. Internal Revenue Service Department of the Treasury Washington DC 20224.

Unlike a 1031 exchange a DST does not require the taxpayer to reinvest in like-kind replacement property and is not subject to the timeline restrictions of a 1031 exchange.

Is There An Irs Ruling For The Deferred Sales Trust Youtube

What Are The Differences Between A Deferred Sales Trust Dst And A Charitable Remainder Trust Crt Reef Point Llc

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust The Other Dst

Tax Deferred Cash Out Risks Are Much Lower Than Deferred Sales Trust

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Deferred Sales Trust Real Estate Tax Strategy

Deferred Sales Trust Max Cap Financial

Deferred Sales Trust Irs Irs Capital Gains Tax

Deferred Sales Trust Irs Irs Capital Gains Tax

Tax Deferred Cash Out Risks Are Much Lower Than Deferred Sales Trust

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust Irs Irs Capital Gains Tax

8 Deferred Sales Trust Ideas Trust Capital Gains Tax Capital Gain

![]()

Deferred Sales Trust Atlas 1031